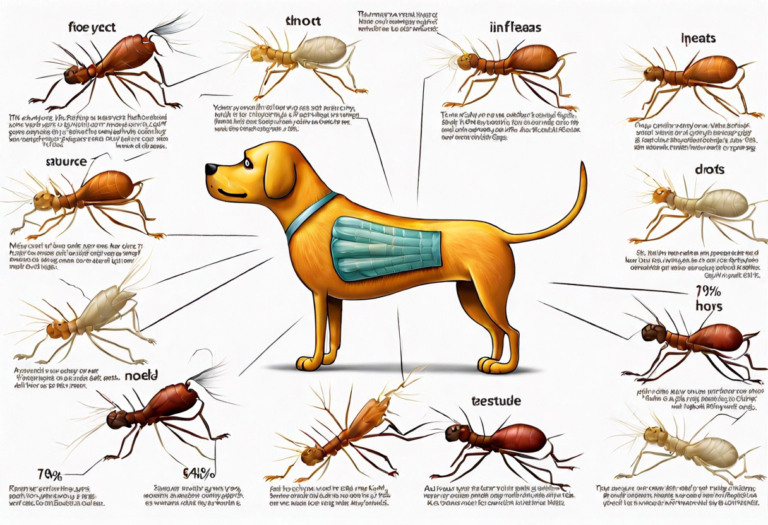

Flea Infestations: Understanding the Numbers on Your Dog

Understanding the Lifecycle of Fleas on Dogs Fleas are a common nuisance for dogs and their owners. Understanding the lifecycle of fleas on dogs is crucial in effectively managing and preventing infestations. From egg to adult, fleas go through a…